Freight mobility technology company Einride has secured US$500m in financing, including a Series C equity raise and a debt facility.

The debt financing – stated to be the largest asset-backed facility to date for heavy-duty electric vehicles – will provide funding for Einride’s fleet of electric vehicles globally. The Series C will deliver funding necessary for Einride to develop and deploy new autonomous and digital solutions in addition to expanding its products to new markets and customers.

The US$300m in debt financing, which consists of an initial facility rollout of US$150m beginning in January 2023, is signed with Barclays Europe and will ensure long-term funding for the technology company’s current and future electric, heavy-duty vehicle fleets. The capacity of these EVs is utilized by Einride’s clients as part of the overall Einride freight ecosystem. The multi-jurisdictional, multi-currency facility supports the company’s international fleet across the USA and Europe. It will also support expansions which are planned.

Einride has also initially secured US$200m in equity contribution led by a consortium of new investors with support from existing shareholders. The new Investors include Swedish pension fund AMF, EQT Ventures, Northzone, Polar Structure, Norrsken VC and Temasek. The equity contribution includes a US$90m convertible note which was raised earlier on in 2022.

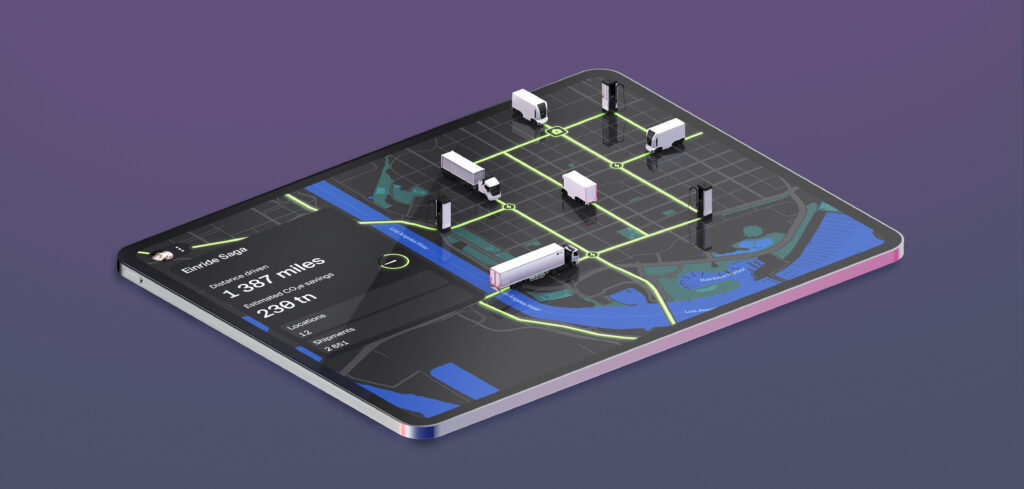

Through the construction of freight mobility grids powered by the company’s ecosystem – consisting of the intelligent Einride Saga platform, electric and autonomous trucking fleets, charging infrastructure and connectivity networks — Einride aims to unlock a resilient, cost-effective future for freight.

“The time is now to act on not only developing but accelerating the implementation of technology that will create a cleaner, safer and more efficient way to move goods,” said Robert Falck, founder and CEO, Einride. “We’ve created the Einride ecosystem to provide the most resilient and future-proof approach to electrifying freight today. With the support from our investors and shared belief in this mission, we’ll continue to drive disruptive change to global freight at scale.”

“This landmark debt facility represents a key milestone in the financing of heavy-duty electric vehicles,” commented Gordon Beck, director of securitized products solutions, Barclays. “The innovative asset-backed structure complements Einride’s unique ecosystem offering and is a continued demonstration of how Barclays is using our financial and capital markets expertise to support clients in driving the transition to net-zero.”